Table Of Content

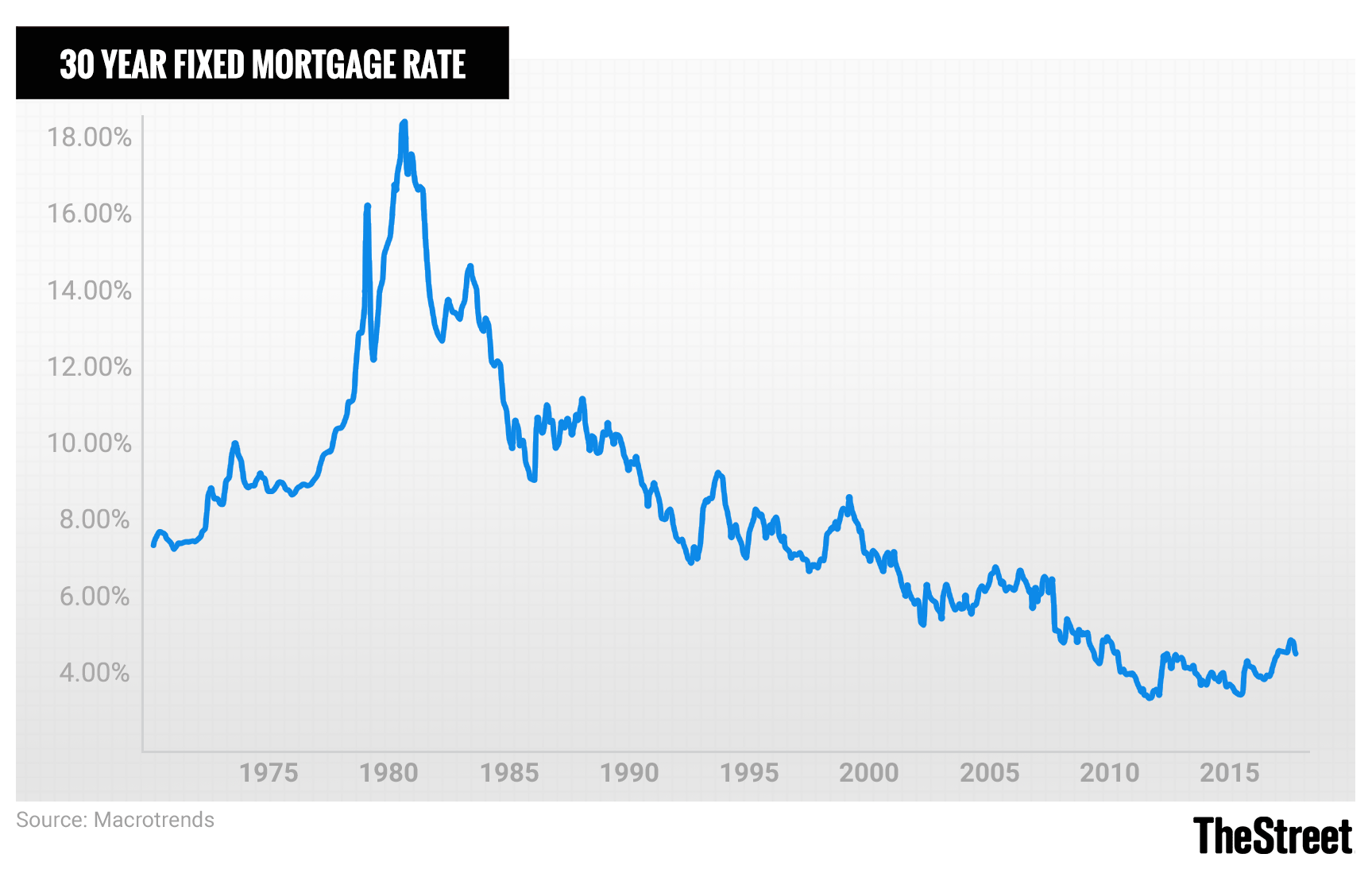

The reason is that your rate will be personalized according to your circumstances. Homeowners who want to lock in a lower rate by refinancing should compare their existing mortgage rate with current market rates to make sure it’s worth the cost to refinance. Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location. Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

What are today's mortgage rates?

You may lock the mortgage rate after you have been approved and up until a few days before the scheduled closing date. As far as timing goes, forecasting rates accurately is impossible. It's best to lock when you are comfortable that you can afford the monthly payments at that interest rate. A 30-year fixed mortgage is a home loan with an interest rate that stays the same over a 30-year period. For example, on a 30-year mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payments would be about $1,111 (not including taxes and insurance). Because the mortgage is fixed, the interest rate of 3.75% (and the monthly payment) will stay the same for the life of the loan.

What’s the difference between APR and interest rate?

The good news is that, despite elevated rates, there are methods you can employ to secure a lower rate. These methods might be especially beneficial if you bought a home between mid-October and early November 2022 or mid-August through early December 2023 when rates were over 7%. Here’s how refinance activity has trended recently, according to the MBA’s Weekly Mortgage Applications Survey. Even so, Cohn expects the Fed to start cutting rates in June or July. The Fed’s latest summary of economic projections maintained the three planned rate cuts for 2024, but Federal Reserve Chair Jerome Powell reiterated the timing of those rate cuts will depend on more inflation data.

First-time homebuyer programs in California

FHA streamline refinance loans also require an upfront mortgage insurance premium (MIP) of up to 1.75% of the base loan amount, plus an annual MIP of up to 1.05% of the base loan amount. Avoid applying for new lines of credit before you apply for a mortgage refinance, as credit applications can bring down your score. However, submitting multiple mortgage applications in an effort to get the lowest rate possible won’t hurt your score.

It’s possible for your initial rate lock to be voided if things like your credit score, loan amount, debt-to-income ratio or appraisal value change during the lock period. These rates, APRs, monthly payments and points are current as of ! They assume you have a FICO® Score of 740+ and a specific down payment amount as noted below for each product. They also assume the loan is for a single-family home as your primary residence and you will purchase up to one mortgage discount point in exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points.

Latest Home Loan Rates In 2024 - Forbes

Latest Home Loan Rates In 2024.

Posted: Tue, 05 Mar 2024 08:00:00 GMT [source]

Estás ingresando al nuevo sitio web de U.S. Bank en español.

Bankrate scores are objectively determined by our editorial team. Our scoring formula weighs several factors consumers should consider when choosing financial products and services. The average rate on a 30-year fixed mortgage was 7.31 percent the week of April 24, while the average rate on a 15-year fixed mortgage was 6.64 percent, according to Bankrate’s weekly national survey of large lenders. Her work has been published or syndicated on Forbes Advisor, SoFi, MSN and Nasdaq, among other media outlets. It can be tricky to time any market, and mortgage rates are no exception. If conditions are choppy, and interest rates are likely to rise, it may be smart to lock in a rate that works with your budget and seems fair to you.

Today's Mortgage Rates: Compare Current Interest Rates - The Motley Fool

Today's Mortgage Rates: Compare Current Interest Rates.

Posted: Thu, 28 Mar 2024 07:00:00 GMT [source]

Federal Housing Administration (FHA) loans

A rate lock means your rate won't change between the day you lock the rate and the day you close — no matter what happens in the market. Further, making a minimum down payment of 20% on conventional mortgages can help you automatically waive private mortgage insurance premiums, which increases your borrowing costs. Buying discount points or lender credits can also reduce your interest rate. Conventional home loans are issued by private lenders and typically require good or excellent credit and a minimum 20% down payment to get the best rates. Some lenders offer first-time home buyer loans and grants with relaxed down payment requirements as low as 3%.

Pros and cons of refinancing

It’s important to understand that buying points does not help you build equity in a property—you simply save money on interest. Answer some questions about your homebuying or refinancing needs to help us find the right lenders for you. Individuals should begin their mortgage search before they begin their home search. This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly. First, your FICO® Score isn't affected by any mortgage inquiries made in the past 30 days. If you find a loan within those 30 days, rate shopping won't affect you at all.

California jumbo loans

The main goal of most mortgage refinances is to lower your interest rate and maximize your savings. An amount paid to the lender, typically at closing, in order to lower the interest rate. One point equals one percent of the loan amount (for example, 2 points on a $100,000 mortgage would equal $2,000). A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum.

As far as which direction interest rates go in the years ahead, Fairweather expects declines. However, the timeline for this downward trend remains uncertain. Top Fed officials themselves have said recently they could hold interest rates high for a while before getting full confidence inflation is heading down toward their target of 2%. In order to provide you with the best possible rate estimate, we need some additional information.

The advantage of going with a broker is you do less of the work and you’ll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender who’s suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also rose this week, lifting the average rate to 6.44% from 6.39% last week. If you can qualify for a better rate or would like to lower your payment by extending your repayment period, consider refinancing. Refinancing is ideal if you can reduce your rate by at least one percentage point and remain in your home long enough to recoup the closing costs. Pursuing a cash-out refinance is worth considering if you want to tap your home equity. If your credit score is below 760, then you might not qualify for the very best rate lenders offer.

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires. Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you don’t have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. On Saturday, April 27, 2024, the national average 30-year fixed mortgage APR is 7.37%. The average 30-year fixed refinance APR is 7.37%, according to Bankrate's latest survey of the nation's largest mortgage lenders.

In addition to the qualification process, refinancing costs can be substantial, totaling up to 6% of the original loan’s outstanding principal. So it’s important to consider whether a refi is the right move for you. If you find any errors on your credit report, be sure to report them to both the credit bureau and the business that made the error as soon as possible. Both parties must correct the information in order for it to change on your credit report and be reflected in your credit score.